CONTACT

CONTACT

OUR TEAM IS READY TO HELP

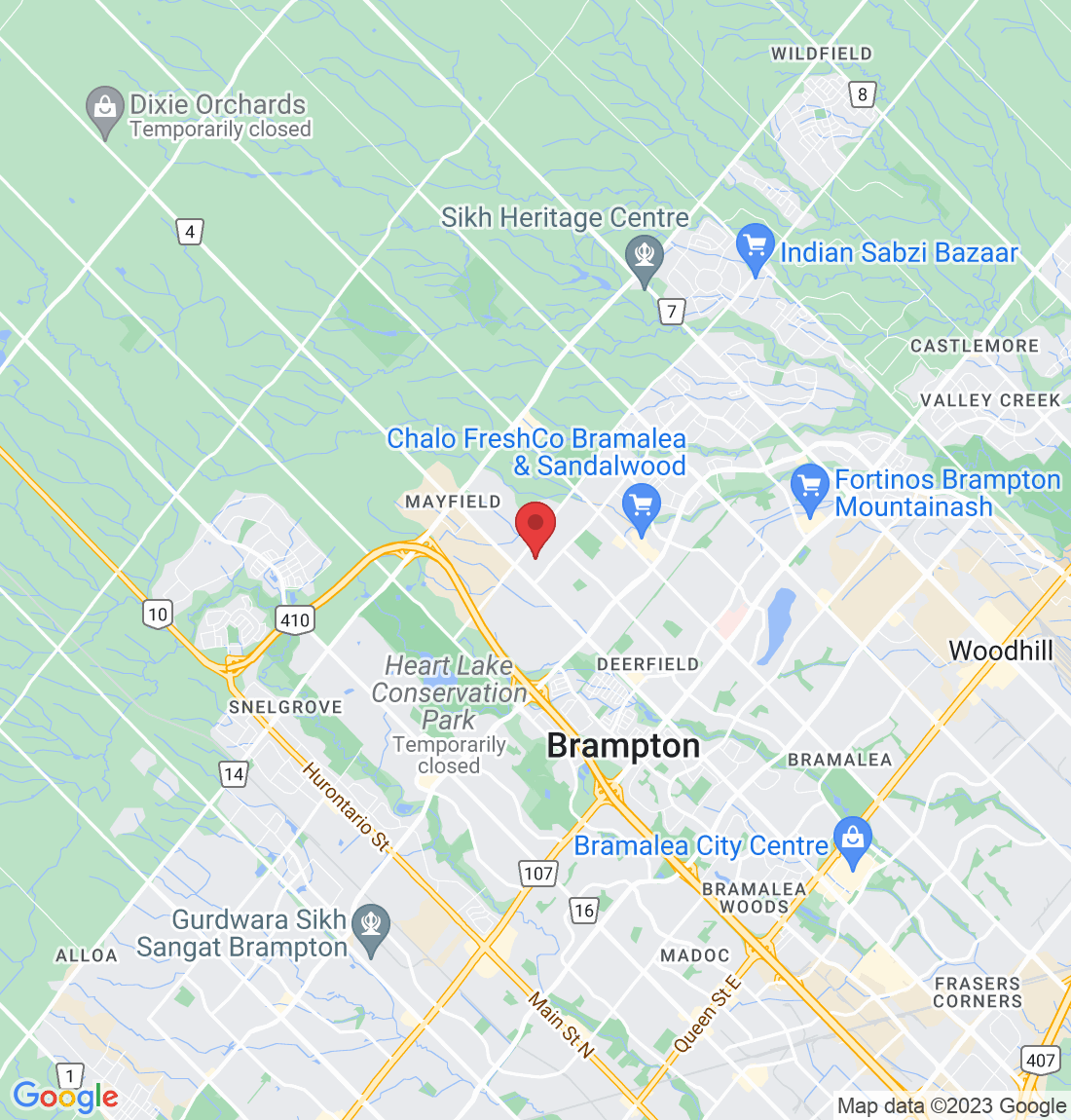

OUR STORE

59 First Gulf Blvd, Unit 2, Brampton, ON, L6W 4T8

PHONE

(647) 504-1524

(905) 793-5464

MAIL ADDRESS

OUR SOCIAL MEDIA

OUR TEAM IS READY TO HELP

OUR STORE

59 First Gulf Blvd, Unit 2, Brampton, ON, L6W 4T8

PHONE

(647) 504-1524

(905) 793-5464

MAIL ADDRESS

OUR SOCIAL MEDIA

HOMZXPERTS

Contact Info

(647) 504-1524

(416) 951-0581

59 FIRST GULF BLVD, UNIT 2, BRAMPTON, ON, L6W 4T8

Quick Links

Home

About US

Properties

Contact US

Facebook

Instagram